In accounting, managing costs before they are actually used or incurred is essential. Prepaid expenses are a great example: when we pay for services or items in advance, like rent or insurance, we don't use them immediately. Instead, these advance payments act as assets until we actually benefit from them. In this guide, we’ll explore the basics of prepaid expenses, using real-life examples to illustrate their purpose, lifecycle, and role in financial statements.

What is a Prepaid Expense?

A prepaid expense is any payment made for a good or service that will be used or consumed in the future. This advance payment is recorded as an asset on the Balance Sheet since it represents a future benefit. As time goes by and we "use up" the prepaid service or good, the asset converts to an expense, accurately reflecting its usage over time.

To relate, imagine buying a 12-month gym membership. Although you pay upfront, the benefit spreads out each month as you use the gym services.

Examples of Prepaid Expenses

1. Insurance Premiums

Scenario: You pay $1,200 in January for a 12-month car insurance policy.

Journal Entry:

January Entry:

Debit: Prepaid Insurance $1,200

Credit: Cash $1,200

Monthly Adjustment (February, March, etc.):

Debit: Insurance Expense $100

Credit: Prepaid Insurance $100

2. Rent Paid in Advance

Scenario: A business pays $6,000 for six months of office rent in advance.

Journal Entry:

○ Initial Entry:

Debit: Prepaid Rent $6,000

Credit: Cash $6,000

○ Monthly Adjustment:

Debit: Rent Expense $1,000

Credit: Prepaid Rent $1,000

3. Annual Subscription Fees

- Scenario: You pay $240 for a year-long software subscription for accounting.

- Journal Entry:

Initial Entry:

Debit: Prepaid Subscription $240

Credit: Cash $240

Monthly Adjustment:

Debit: Subscription Expense $20

Credit: Prepaid Subscription $20

These examples show how prepaid expenses transition from assets to expenses gradually, matching their actual usage.

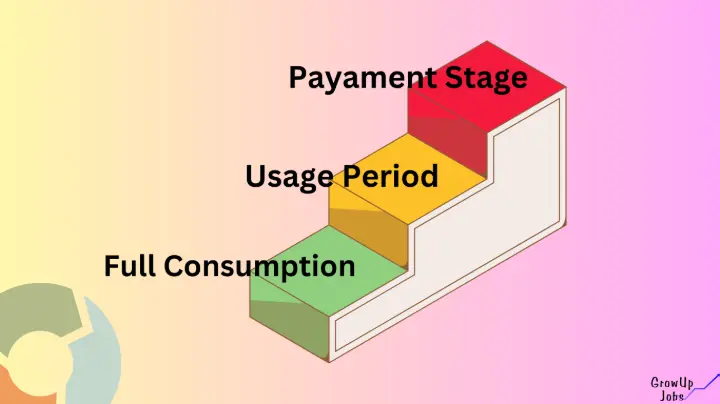

The Life Cycle of a Prepaid Expense

Steps in Managing Prepaid Expenses:

- Payment Stage

- Usage Period

- Full Consumption

- Payment Stage: Record the prepaid expense as an asset on the Balance Sheet.

Example: Debit Prepaid Expense, Credit Cash.

- Usage Period: Each month, reduce the prepaid amount and record it as an expense.

Example: Debit Expense Account, Credit Prepaid Expense.

- Full Consumption: When the service is fully consumed, the prepaid balance reaches zero.

Example: By the final month, there is no remaining prepaid asset; it's entirely recognized as an expense.

Where Prepaid Expenses Appear in Financial Statements

- Balance Sheet: Initially recorded under Current Assets, prepaid expenses reflect the remaining unused portion of the advance payment.

- Profit & Loss (P&L) Statement: As the service or item is "used up," a portion of the prepaid expense moves to the P&L as a monthly expense (e.g., rent or insurance).

- Cash Flow Statement: When the initial payment is made, it affects the cash flow from operating activities as a cash outflow.

T-Account Example for Prepaid Insurance

Here’s how a T-account might look for a $1,200 annual insurance premium, recognized at $100 per month:

Prepaid Insurance (Asset Account)

---------------------------------------

Debit (Dr) | Credit (Cr)

---------------------------------------

$1,200 (Paid) |

| $100 (Expense - Jan)

| $100 (Expense - Feb)

| ...

| $100 (Expense - Dec)

---------------------------------------

Balance: $0 |

Each month, $100 is moved from the Prepaid Insurance asset to the Insurance Expense until the balance reaches zero.

FAQs About Prepaid Expenses

Why are prepaid expenses recorded as assets?

Because they provide future benefits and haven't been used up yet, prepaid expenses initially count as assets.

How do prepaid expenses affect cash flow?

They reduce cash flow initially, but as they convert to expenses, they help balance out monthly expenses.

What’s the difference between prepaid and accrued expenses?

Prepaid expenses are paid in advance, while accrued expenses are incurred but not yet paid.

How are prepaid expenses reviewed?

Monthly or quarterly, to ensure accurate expense recognition and align with financial periods.

Are prepaid expenses tax-deductible?

They’re deductible when they’re recognized as an expense, following tax regulations.

Wrapping Up

Prepaid expenses are key to understanding cost management in accounting. By recording payments as assets initially, we align expenses accurately over time, improving budgeting and clarity in financial statements.